Ira early withdrawal penalty calculator

You die or become permanently disabled. Use this early withdrawal penalty calculator to find the effective APY when closing a CD before maturity.

Pin On Financial Independence App

Individuals must pay an additional 10 early withdrawal tax unless an exception applies.

. Use this calculator to see what your net withdrawal would be after taxes and penalties are taken into account. Avoiding the Early Withdrawal Penalty There are some hardship exceptions to penalty charges for withdrawing money from a traditional IRA or the investment-earnings portion of a Roth IRA before you. This amount will still be considered taxable income.

The Substantially Equal Periodic Payment rule allows you to take money out of an IRA before the age of 59 12. If you have not owned a primary residence in the past two years you can withdraw up to 10000 without incurring the 10 early withdrawal penalty additional amounts have the 10 penalty. You can set up an IRA with a bank insurance company or other financial institution.

Simply enter the term apy and penalty for early withdrawal and you will see a breakdown of what the effective APY would be if you were to withdraw the money. Individuals must pay an additional 10 early withdrawal tax unless an exception applies. Early Withdrawal Penalty 1-Year CD Early Withdrawal Penalty 5-Year CD.

There are several different types of IRAs including traditional IRAs and Roth IRAs. Best age to take Social Security. On top of that the IRS will assess a 10 early distribution tax penalty and the conversion will ultimately not take place.

The magic ages of 59 12 and 70 12 For reasons now lost to legislative history lawmakers set the age for taking penalty-free distributions from your IRA at 59 12. If you are under 59 12 you may also be subject to a 10 early withdrawal penalty. Find out how to calculate your 401k penalty if you plan to access funds early.

Concerning Roth IRAs five years or older tax-free and penalty-free withdrawal on earnings can occur after the age of 59 ½. The issue that complicates this decision is the interest penalty that is charged when you break a CD. You can avoid an early withdrawal penalty if you use the funds to pay unreimbursed medical expenses that are more than 75 of your adjusted gross income AGI.

New parents can now withdraw up to 5000 from a retirement account to pay for birth andor adoption expenses penalty-free. Early withdrawals from a 401k retirement plan are taxed by the IRS. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus.

It also lets you avoid the 10 penalty taxThis approach is also called 72t payments because the rule falls under IRS code section 72t. These payments are also called SEPP payments. Best and worst states for retirement.

The amounts withdrawn arent more than your your spouses your childs andor your grandchilds qualified higher-education expenses paid during 2021. An individual retirement arrangement IRA is a tax-favored personal savings arrangement which allows you to set aside money for retirement. The IRS may waive the 60-day.

You wont have to pay the early-distribution penalty 10 additional tax on your Roth IRA withdrawal if all of these apply. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401k or 403b plans among others can create a sizable tax obligation. Before making a Roth IRA withdrawal keep in mind the following guidelines to avoid a potential 10 early withdrawal penalty.

Withdrawals must be taken after a five-year holding period. Will be taxable in the year received. How to avoid early.

Withdrawals must be taken after age 59½. As a result of the June 2020 CARES Act retirement account holders affected by the Coronavirus could access up to 100000 of their retirement savings as early withdrawals penalty free with an expanded window for paying the income tax they owed on the amounts they withdrew. Exceptions to the Early Withdrawal Penalty.

Due to this penalty it may be better to just keep the current CD until maturity. Should you keep the CD or break it and reinvest your money into a new CD. The Best 401k Companies If You Are Under 59 12.

Roth IRA withdrawal and penalty rules vary depending on your age and how long youve had the account and other factors. So you might be able to avoid that 10 401k early withdrawal penalty by converting your 401k to an IRA. Exceptions for Both 401k and IRA.

Generally the amounts an individual withdraws from an IRA or retirement plan before reaching age 59½ are called early or premature distributions. The 10 percent early withdrawal penalty was also waived for withdrawals made between Jan. 401K and other retirement plans.

The effective APY takes into account the loss from the early withdrawal penalty. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years. Making a withdrawal from your Fidelity 401k prior to age 60 should always be a last resortNot only will you pay tax penalties in many cases but youre also robbing yourself of the tremendous benefits of compound interestThis is why its so important to maintain an emergency fund to cover any short-term.

If you return the cash to your IRA within 3 years you will not owe the tax payment. This tool is intended to help you decide which option will make you the most money. The following COVID information was for 2020 Returns.

While you still have to pay taxes on any money taken out of a 401k or IRA before a certain age there are some circumstances that would let you get around the 10 early withdrawal penalty for retirement funds. Traditional IRA calculator. There are special provisions for first-time home buyers if you have an IRA.

Birth or adoption expenses. Individual retirement accounts have slightly different withdrawal rules from 401ks. Once you reach this age you.

Roth Ira Calculator Roth Ira Contribution

7 Ways To Find The Best Ira Calculator For Ira Distributions Withdrawal And Retirement Calculations Advisoryhq

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

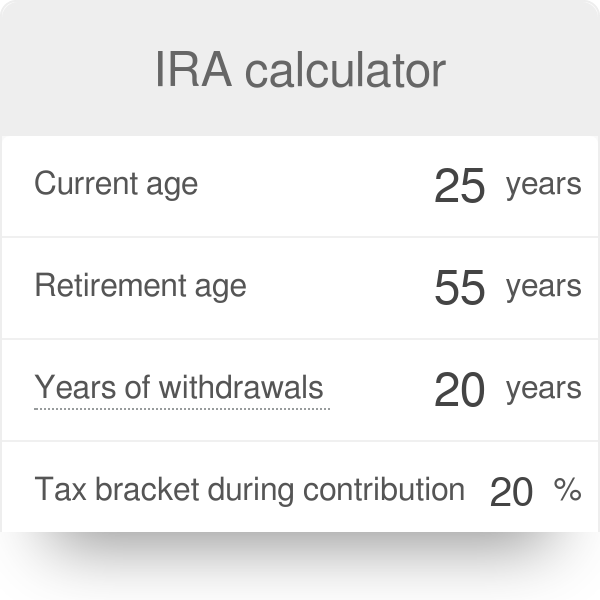

Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Retirement Withdrawal Calculator For Excel

Employee Cost Calculator Quickbooks Quickbooks Calculator Employee

What Do I Need To Do To Calculate And Correct An Excess Ira Contribution Legacy Design Strategies An Estate And Business Planning Law Firm

How To Make An Early Withdrawal From Your Ira Without Paying The Fee Individual Retirement Account Men Casual Retirement Accounts

Irs Wants To Change The Inherited Ira Distribution Rules

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Indiana Uses The Taxpayer S Federal Adjusted Gross Income To Calculate The Amount Of State Tax Owed Because Of This Th Us Tax Tax Forms Adjusted Gross Income

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Iras 401 K S Other Retirement Plans Strategies For Taking Your Money Out By Twila Slesnick Phd Enrolled Agent Nolo Retirement Planning Money Book Enrolled Agent

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator